4 Tips on How to Sell a House by Owner in NJ

Are you planning to sell a house by owner in NJ (meaning you are not working with an agent)? You should read this informative guide.

Selling a House in NJ can be a complex process, but when you’re looking to sell your home in Bergen County, going the “for sale by owner” (FSBO) route might be the right choice for you. By selling your home on your own, you can save money on real estate agent commissions and have greater control over the sales process. However, selling a home on your own can also be challenging, and there are several important factors to consider when going the FSBO route.

Tips on How to Sell a House by Owner in NJ

1. Price Your Home Appropriately

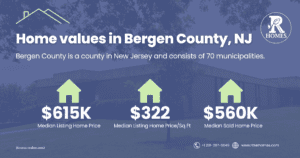

One of the most important factors to consider if you want to sell a house by owner in NJ is pricing it appropriately. To do this, research comparable homes in your area and consider working with an appraiser to determine the fair market value of your home. Pricing your home too high can turn off potential buyers, while pricing it too low can mean leaving money on the table.

2. Prepare Your Home for Sale

If you want to successfully sell a house by owner in NJ, make sure it’s in top condition. This means making any necessary repairs or upgrades, decluttering and depersonalizing the space, and staging the home to showcase its best features. Preparing your home for sale is a crucial step that can make all the difference in attracting potential buyers and getting the price you want.

Tips to help you prepare your home for sale:

- Declutter and Depersonalize: Start by removing all clutter and personal items from your home. This allows potential buyers to imagine themselves living in the space, rather than feeling like they’re intruding on someone else’s personal space.

- Deep Clean: A clean home is a must when it comes to selling your property. Make sure to deep clean every room, including baseboards, walls, and carpets. Pay special attention to the kitchen and bathrooms, which are often the most heavily scrutinized areas of the home.

- Make Repairs: Address any outstanding repairs or issues that may deter buyers, such as leaky faucets or peeling paint. These small repairs can make a big difference in the overall appearance and value of your home.

- Neutralize Decor: If your home has any bold or eccentric decor, consider neutralizing it to appeal to a wider range of potential buyers. This includes painting bright walls a neutral color, removing bold wallpaper, or replacing quirky light fixtures.

- Stage Your Home: Consider staging your home to showcase its potential to potential buyers. This can be as simple as rearranging furniture to make a room feel more spacious or adding fresh flowers to create a welcoming atmosphere.

3. Market Your Home Effectively

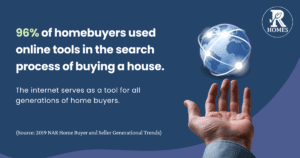

To attract potential buyers, you’ll need to market your home effectively. This can include creating high-quality listing photos and descriptions, placing ads in local newspapers or online marketplaces, and social media platforms. Social media platforms like Facebook, Twitter, and Instagram have millions of users, which means that you can reach a wider audience when you use these platforms to promote your home listing. Consider working with a professional photographer to capture your home in its best light and use social media to share your listing with your network.

4. Negotiate and Close the Sale

When you receive an offer, make sure you understand the terms and work with the buyer to negotiate a mutually beneficial agreement. To sell a house by owner in NJ you should consider negotiating the price, closing timeline, and any contingencies. Once you’ve reached an agreement, work with a real estate attorney to finalize the sale.

Selling a house in NJ as a for sale by owner can be overwhelming, but by approaching the process with a clear understanding of the challenges involved, by pricing your home appropriately, preparing it for sale, marketing it effectively, responding to inquiries, and negotiating the sale, you can increase your chances of success. If you need additional guidance or support, you can also consider working with a real estate attorney or professional FSBO seller service to help you navigate the process with confidence.

At Ritsel Homes, we understand that to sell a house by owner in NJ you need time and effort. That’s why we offer to buy your house for cash as-is, which means you don’t have to worry about making costly repairs or renovations to impress picky buyers. With our proven expertise and vast resources, we can help you sell your home quickly, without having to wait for months on end for the right buyer to come along. So if you’re ready to say goodbye to your old home and move on to the next chapter of your life, contact us today at (201) 379-6565.