In the world of real estate, you never know what is on the horizon. There are plenty of times when a situation is thrown on your lap completely out of the blue with unfamiliar circumstances. Such can the case with inherited properties. Dealing with an inherited property or a property in probate can be one of the most difficult and time-consuming processes you can go through. Because of the many laws and red tape associated, an inherited property can take months before the title changes hands. When it finally does, you can be left with a property that hasn’t been updated in years and is in dire need of maintenance. This puts you in the proverbial “catch 22” of not knowing exactly what to do with the property to maximize the bottom line.

Common Challenges When Selling An Inherited Property

If you are faced with this type of situation, it is important to focus on the high-priority hurdles first. Here are the four biggest challenges to selling an inherited property with deferred maintenance:

- Limited Capital

- High Carrying Costs

- Selling a Fixer-Upper

- Lack of Local Market Knowledge

Limited Capital to Fix Up:

In a perfect world, you would have access to unlimited capital and do whatever work is needed on the property. Unfortunately, this may not be the case. Money may be tied up in other properties, your line of credit may be maxed, or you don’t have the capital to do the work the property requires. Without enough funds, you won’t be able to make the improvements you desire, leaving you with limited selling options. There is little question that buyers almost universally want to buy a turn-key property unless they get a severe discount. If you don’t make improvements, your buyer pool will be limited, and it will be reflected in your sales price. You can try finding capital through credit cards, private lenders, or short-term partnerships, but each option has drawbacks and will diminish your bottom line.

High Carrying Costs:

The biggest issue with hanging onto the property for any period of time is the carrying costs. Every month you own the property, you must cover the property taxes, insurance, utilities, and a slew of other expenses. This is not to mention the payment to your attorney for their work on the probate and any other fees along the way. By not selling right away, you can quickly get behind the eight ball, forcing more desperation and prompting you to make decisions with the property you normally would not. What you may think you are saving by not initially making improvements you end up losing by carrying the property.

Selling A Property That Needs Work:

If you don’t have the capital to make improvements, you are forced to sell the property in as-is condition. You essentially defer the responsibility of the improvements from you to the buyer. This creates numerous problems for many reasons. As we stated, your buyer pool will immediately decrease. Many buyers don’t have the desire or financial wherewithal to throw money into a new home purchase. Buyers have a tough enough time coming up with any significant down payment, let alone money for improvements. This leaves you with a buyer pool of investors and buyers looking for a discount. On the surface, you may think that any profit you can get from an inherited property is a bonus. In reality, there are many fees and expenses that are associated that need to be recouped. Additionally, if the inherited lacks equity, your bottom line won’t be nearly as big as you may think. With an as-is sale, you will most likely have to pick the best of potentially low cash offers.

Know your options! Learn what your inherited property is worth and Submit your info today!

Lack Of Local Market Knowledge:

Inherited property doesn’t have to come from someone in your immediate family. If there are limited options, you may be the only choice in your extended family. It would be great if the property were in a market you grew up in or know like the back of your hand. However, what if it is on the other side of your state, or even a few states over? This requires a completely different strategy, regardless of what you want to do with the property. Having capital is great, but you could essentially be throwing money away if you don’t use it wisely. You need to make the right improvements for the market to maximize the profit and expedite the sale. Doing a little research online is helpful, but nothing replaces actual knowledge and first-hand experience in the market. Reach out to a few local real estate agents and contractors to help guide you through your options. Always talk to at least three of each before committing to anyone.

Inherited Property FAQs

Let’s answer some of the most common questions that are asked about inherited properties:

- Timeframe for Selling

- Siblings Forcing a Sale

- Tax Implications

What is the Timeframe for Selling An Inherited Property?

Going through probate can be a long and grueling process, even if there is a will. By the time you take ownership, you can easily feel drained and beaten down. The last thing you want to do is wait another extended period to complete your improvements and wait for a buyer. If there is an extensive amount of work needed in the property, you have two choices.

- Do whatever repairs and work that is necessary, regardless of how long it takes. Waiting a month or two to get the work done has significant advantages.

- Entertain a quick sale and take the first halfway decent offer. If not, it can easily be another handful of months before another offer comes your way.

Most buyers want their properties fresh, updated, and turn key. If there is deferred maintenance, you need to strongly consider doing the work before putting the home on the market.

Can Siblings Force the Sale of Inherited Property?

If a will/trust is set up properly, one of the heirs will be chosen as the executor. The executor is the main decision-maker and does have the power to sell the property without permission from the other heirs.

But sometimes, there’s no executor chosen, which may cause a challenging situation for the heirs. Three things can happen:

- Agreement

- Buyout

- Partition

In a best-case scenario, the heirs would agree about what to do with the property. But an agreement can be hard to come by. In some cases, the siblings are estranged and have difficulty cooperating. In other cases, the siblings are at different points in their lives and may desire different things: one may want the house to live in, while another might want to sell and collect the cash. In some scenarios, a sibling may live far away and not have much insight into the property.

A buyout can help resolve disagreements between siblings. Siblings can buy out the other shares of the property and take full control of it. This is a good option if you’re willing to pay a little more money to assume full control of the property or if you want to relinquish yourself from the property entirely.

If no buyouts can be arranged, then a sibling may file a partition. A partition asks the court to order the house to be sold. At this stage, lawyers will be brought in, and there’s likely to be a lot of legal and financial stress on all parties involved.

The court will review buyout scenarios and decide whether the property will be divided between the siblings or sold with the revenue to be shared equally.

If you or a loved one is planning a will/trust, make sure there’s an assigned executor so these types of problems can be avoided.

How Does Selling Inherited Property Affect Taxes?

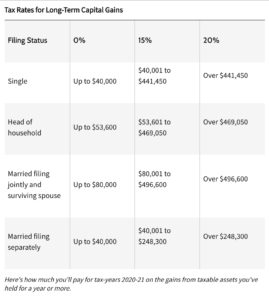

When you sell an inherited property, you may have to pay capital gains tax if you earn a net profit from the sale. The federal government will tax a portion of the amount you profited. The current capital gains tax rates are 0%, 15%, or 20%, depending on your tax bracket.

When you sell a home under ordinary circumstances, you would pay capital gains tax on what you earned from the sale compared against how much you paid for it. So if you bought a house for $300,000 and sold it for $500,000, your tax basis would be $200,000.

That’s not how it works for inherited properties. With inherited properties, the home is appraised after the owner’s death and given a market value. Let’s assume that an owner dies and the house is given a value of $400,000. If the house were sold for $450,000, the tax basis would be $50,000. This is known as a “stepped-up tax basis.” The home’s original value when the owner bought it is not taken into account.

Heads Up: As of early 2021, there are talks by the Biden Administration to raise the capital gains tax for individuals earning at least $1 million per year.

Ritsel Homes together with CT Homes are not tax experts. If you’re seeking tax advice, be sure to consult with a certified tax professional.

We make selling your

inherited property easy,

straightforward, and

seamless. Get a Cash Offer

today!

SOURCE: CT Homes (Inheriting A House: The Challenges of Selling)