Navigating the Current Real Estate Market Trends: What Sellers Need to Know

The real estate market is experiencing a unique time in history. The market is shifting and evolving at a rapid pace, and both homebuyers and sellers need to be aware of the changes to make informed decisions. In this article, I will discuss the current real estate market trends, and the factors affecting the market, and provide insights on how to navigate the market as a seller.

The Current Real Estate Market Trends

The real estate market has been on a rollercoaster ride in the past year. The COVID-19 pandemic caused a significant shift in the market, with many people opting to move out of crowded cities and into more spacious suburban areas. This resulted in a surge in demand for homes, and a shortage of inventory in many areas. As a result, the market became a seller’s market, where sellers had the upper hand in negotiations.

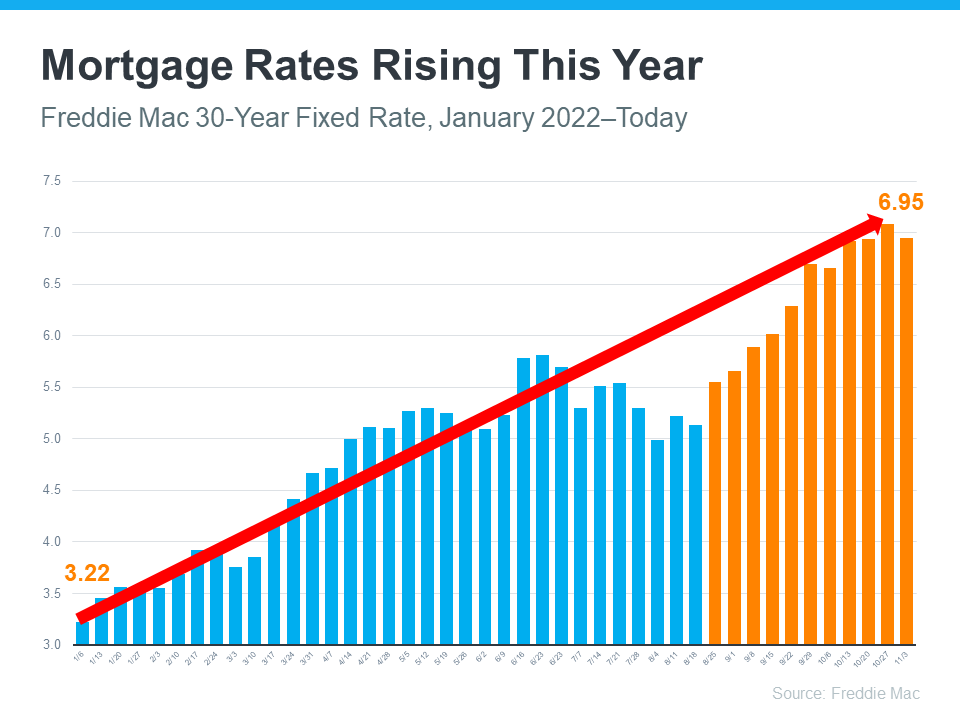

However, the market is now experiencing a shift as the pandemic eases and the world adapts to the new normal. As the market is starting to cool down, with inventory increasing and demand decreasing. This means that the market is shifting towards a buyer’s market, where buyers have more bargaining power.

Factors Affecting the Real Estate Market

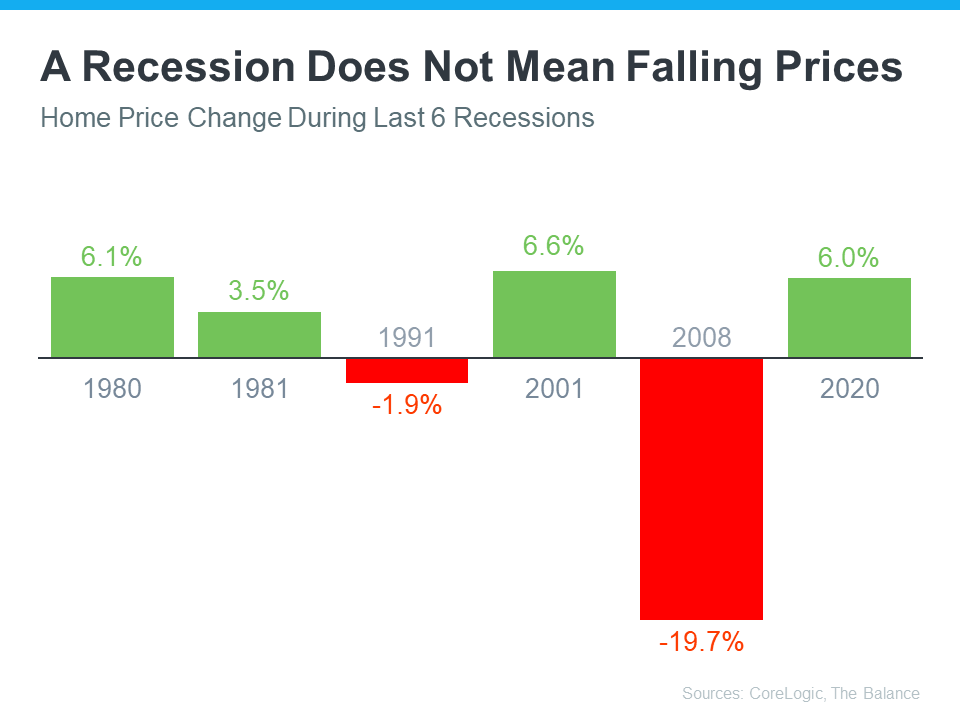

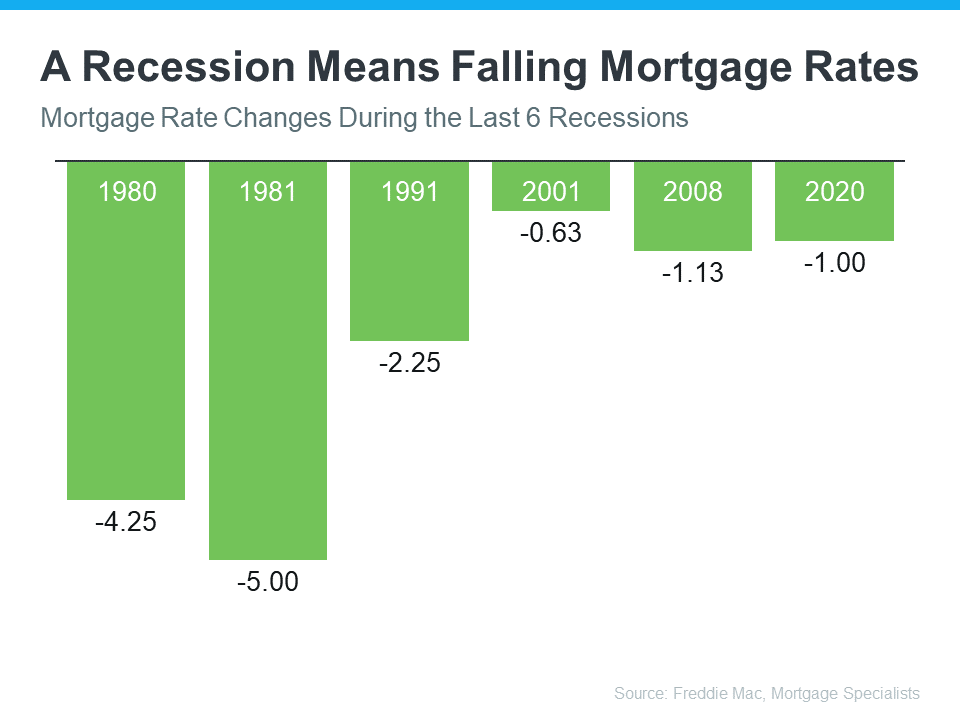

Several factors are affecting the current real estate market trends. One of the most significant factors is the economy. As the economy continues to recover from the pandemic, interest rates are expected to rise, which can affect the affordability of homes. Additionally, changes in government policies, such as tax reforms and regulations, can also impact the market.

Another significant factor is demographics. The millennial generation is now entering the homebuying market, and their preferences and priorities are different from previous generations. Millennials tend to prioritize affordability and location, which has resulted in a surge in demand for suburban homes.

The pandemic has changed the way people work and live, and many are now looking for homes that can accommodate remote work and homeschooling. This has resulted in a shift in demand towards larger homes with more space.

It’s important to note that the market is still highly competitive, especially in certain areas. For example, in hot markets like San Francisco and New York City, homes are still selling for well above the asking price. Sellers need to be aware of the market conditions in their specific area and adjust their selling strategy accordingly.

Selling Trends—How to Navigate the Seller’s Market

The seller’s market has been dominant for the past year, and many sellers have taken advantage of the high demand and low inventory to sell their homes quickly and at a high price. But with the market shifting towards a buyer’s market, sellers need to adjust their approach to remain competitive.

One of the most important things sellers can do is to price their homes correctly. In a seller’s market, sellers can typically price their home higher than market value and still receive multiple offers. On the contrary, in a buyer’s market, buyers have more bargaining power, and overpriced homes tend to sit on the market longer.

Sellers should work with an experienced agent or real estate solutions provider to sell their homes based on market conditions. Another important strategy is to focus on the presentation of the home. In a competitive market, homes that are well-staged and well-maintained tend to sell faster and for a higher price. Sellers should invest in professional staging and cleaning to make their homes more appealing to buyers.

Tips for Navigating the Current Real Estate Market as a Seller

Navigating the current real estate market as a seller can be challenging, but several tips can help sellers stay ahead of the game.

Sellers should be prepared to be flexible with their selling strategy. In a changing market, what worked six months ago may not work now. Sellers should be open to adjusting their pricing, marketing, and presentation strategies to remain competitive.

Sellers should be patient. With the market shifting towards a buyer’s market, it may take longer to sell your home than it would have a year ago. However, with the right strategy and solution, you can still sell your home for a fair price.

Conclusion and Key Takeaways

The current real estate market is experiencing a significant shift, and sellers need to be aware of the changes to make informed decisions. The market is shifting towards a buyer’s market, but there are still opportunities for sellers to sell their homes quickly and for a fair price.

If you’re a seller, it’s essential to work with a real estate solutions provider like Ritsel Homes, who will potentially buy your home for cash without the need to pay realtor commissions. We can also provide you with various solutions tailored to your unique circumstances.

Additionally, you should focus on pricing your home correctly, presenting your home in the best possible light, and being flexible with your selling strategy.

By following these tips and staying informed about the market trends, you can successfully navigate the current real estate market and sell your home for a fair price.